Chapter 7 vs Chapter 13 Bankruptcy

The Differences Between Chapter 7 & Chapter 13 Bankruptcy

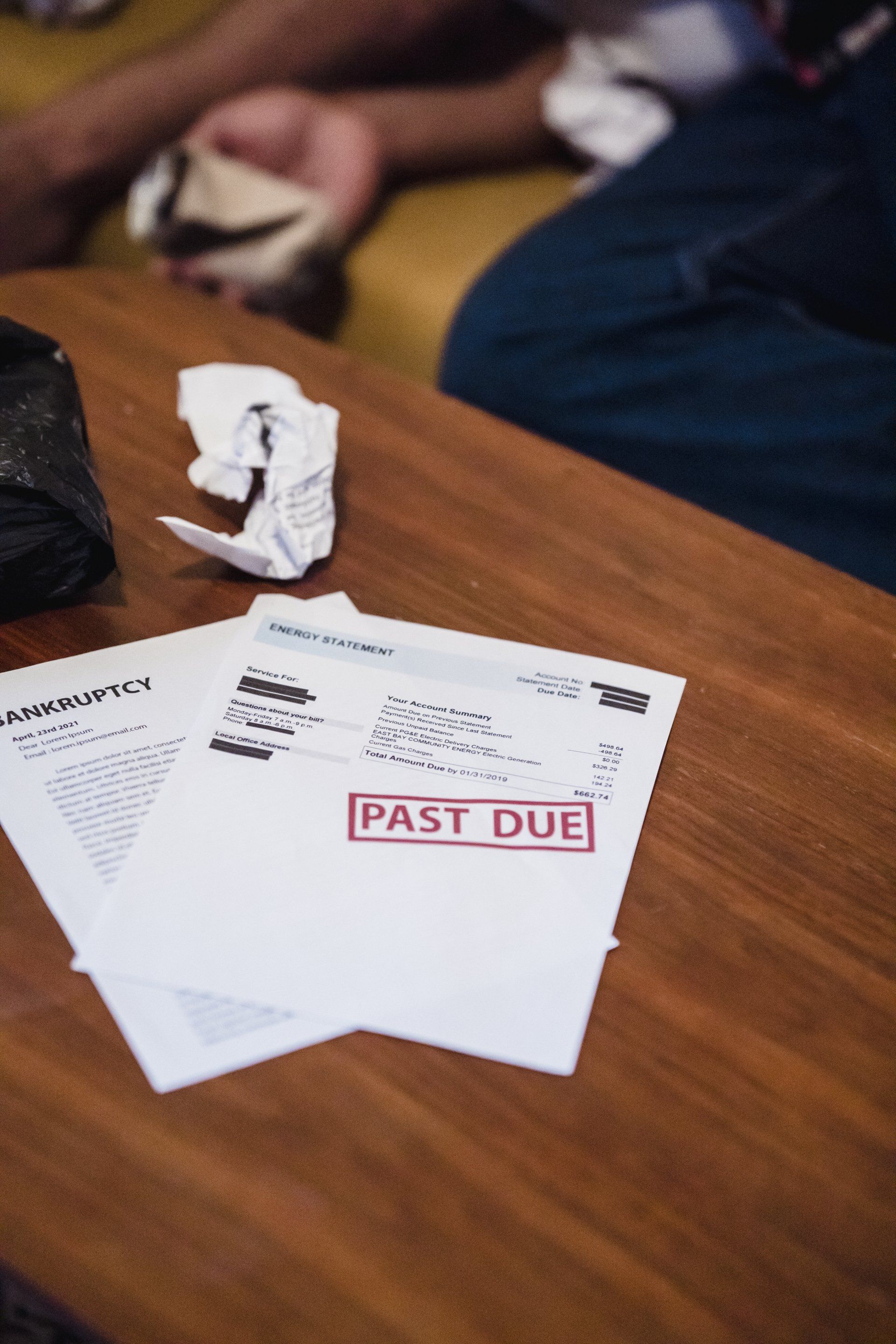

Financial troubles plague millions of Americans. Every year, thousands of them file for bankruptcy. We take on debt to afford things that we need such as our homes and vehicles. It is the only way most of us can afford these necessities. Unfortunately, life circumstances change. Changes can include being laid off from work, getting injured, or a loved one getting sick. This causes us to be unable to meet our financial obligations. When this happens, filing for bankruptcy is an option that can relieve our financial obligations. There are two options: Chapter 7 and Chapter 13 bankruptcy. The key differences can be found below.

Chapter 7 Bankruptcy

- Liquidation of Debt

- Individuals & Business Are Eligible

- Must Pass the Means Test

- Can Sell All Non-Exempt Property to Pay Creditors

Chapter 13 Bankruptcy

- Restructuring of Debt

- Only Individuals Are Eligible

- No More Than $415,275 of Unsecured Debt & $1,257,850 of Secured Debt

- Keep All Property

Contact Our Bankruptcy Attorney Today!

Roger R. Compton, Attorney At Law is a bankruptcy lawyer serving the Hope Mills, NC area. Filing for bankruptcy is a complex process. There are several types of bankruptcy, and the type that is right for you will depend on your circumstances and qualifications. Our attorney will explain all your bankruptcy options and help you decide which is best for you. We will also take care of filing all paperwork and review it for accuracy. Contact us today to schedule your bankruptcy consultation!