Will Filing for Bankruptcy Affect My Taxes?

How Filing for Bankruptcy Affect Your Taxes

In short, the answer is yes, filing for bankruptcy can impact your taxes and how you will need to file your taxes. Both can be challenging and frustrating processes, but filing for bankruptcy can add an additional layer of frustration. To understand how filing bankruptcy can affect your taxes, let's take a look at the processes involved and how you can make it easier for yourself.

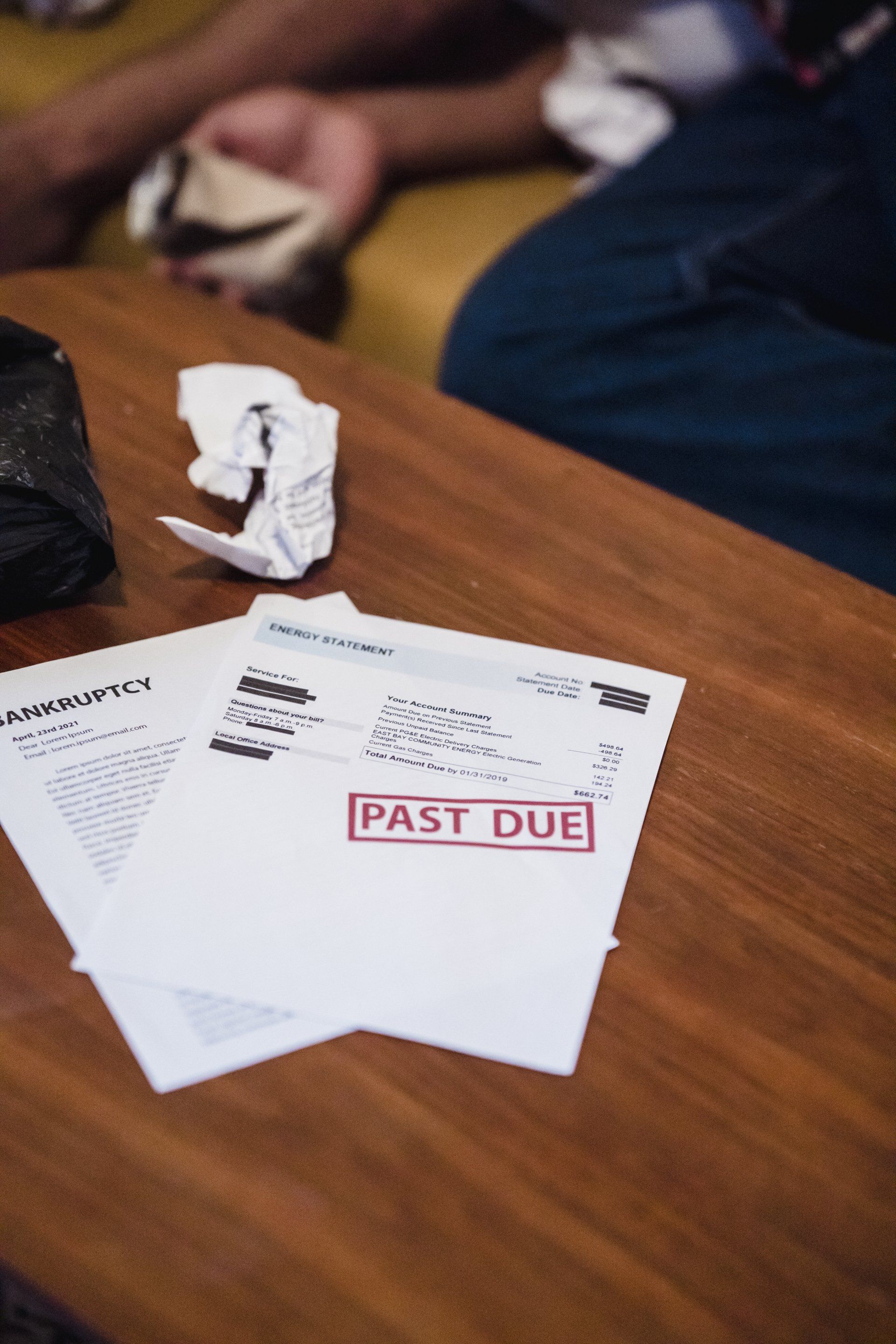

Bankruptcy can be viewed as a second chance to recoup and improve personal finances, either by providing an alternative payment plan or by eliminating your debt entirely. Once you've filed for bankruptcy, creditors are effectively blocked from being able to pursue you for repayment. Filing for bankruptcy will look slightly different, depending on which type of bankruptcy you are intending to file for, such as Chapter 7 or Chapter 13 bankruptcy. The type of bankruptcy you file for will also impact how you will need to file your taxes.

Chapter 7

Chapter 7 bankruptcy requires personal assets to be sold to pay off your debt, also known as "liquidation". You will also need to file and pay for your personal taxes. If a trustee is assigned to you, then they will also need to file Form 1041, for the sake of the bankruptcy estate.

Chapter 11

This type of bankruptcy is most common in commercial use and for businesses. The debtor typically remains in possession of their property and financial assets; however, you are also appointed an trustee and are able to borrow money. You will also still need to file Form 1040, and your trustee should also file Form 1041.

Chapter 13

Chapter 13 provides the debtor with the option to develop a debt repayment plan, in which they can pay off portions or all of their debt over time. This is the most common type of bankruptcy for the individual person, and repayment is made over the course of three to five years. Creditors also cannot pursue your for debt collection while your case remains active. You will also need to file and pay your taxes as normal.

Tax refunds may or may not belong to your estate, and instead the bankruptcy estate, in these cases:

- Tax years prior to the filing of Chapter 7 or Chapter 11 bankruptcy means that you will receive a tax refund

- After filing for Chapter 7 or Chapter 11 bankruptcy, your tax refunds belong to the bankruptcy estate

- While your case remains active, your refunds will be included in your estate under Chapter 13

Contact Our Bankruptcy Attorney Today!

Seeking the guidance of a bankruptcy attorney can help not only provide advice, but also the support throughout the process you need. The bankruptcy attorney will have the knowledge and experience required to address your case with compassion and the necessary skill set to file properly. Roger R. Compton, Attorney at Law is here to help! Our bankruptcy attorney serves Fayetteville, Spring Lake, and Hope Mills, NC. If you are looking to file bankruptcy, or want more information about what to do after filing for bankruptcy, contact us today!